utah county sales tax calculator

Start filing your tax return now. As far as other cities towns and locations go the place with.

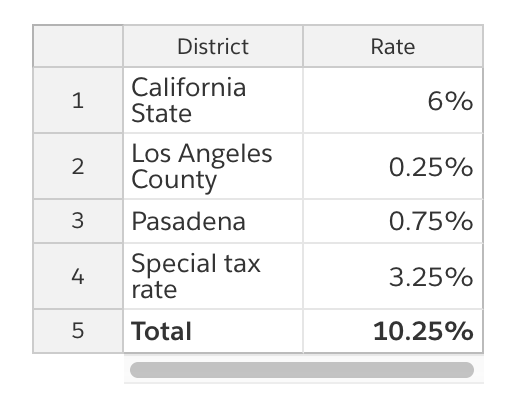

How To Charge Your Customers The Correct Sales Tax Rates

Our free online Utah sales tax calculator calculates exact sales tax by state county city or ZIP code.

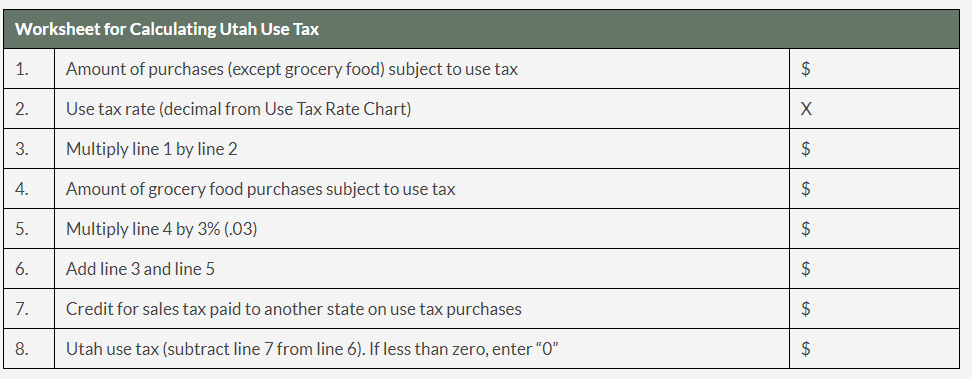

. Our free online Utah sales tax calculator calculates exact sales tax by state county city or ZIP code. Or visit our Utah sales tax calculator to lookup local rates by zip code. 93 rows All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov.

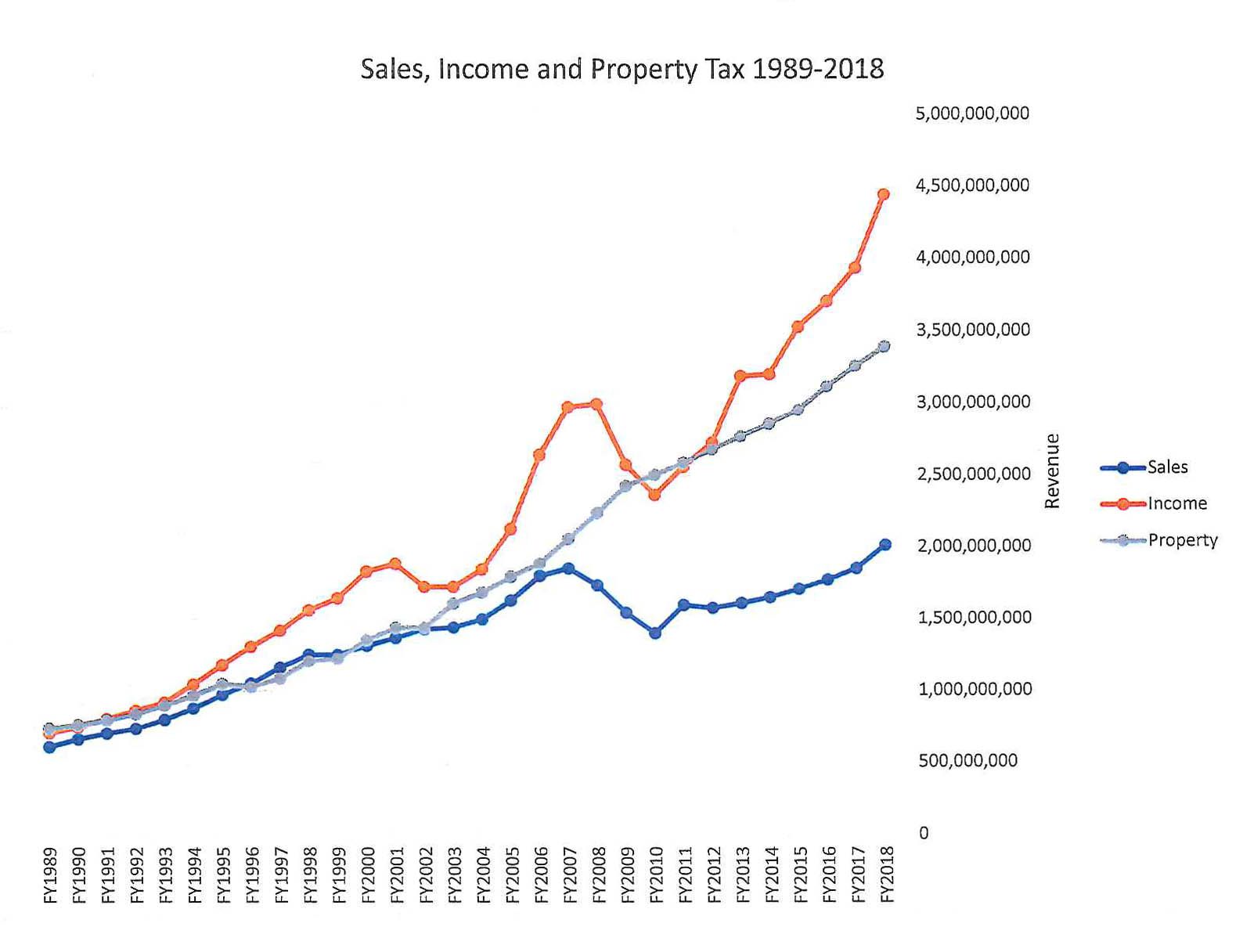

The average cumulative sales tax rate in the state of Utah is 69. That rate could include a combination of. You can find more tax rates.

Utah County in Utah has a tax rate of 675 for 2022 this includes the Utah Sales Tax Rate of 595 and Local Sales Tax Rates in Utah County totaling 08. The Utah state sales. 271 rows 2022 List of Utah Local Sales Tax Rates.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. To find out the amount of all taxes and fees for your. Lowest sales tax 61 Highest sales tax 905 Utah Sales Tax.

Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov. Find your Utah combined state and local tax rate. Start filing your tax return now.

Utah is an origin-based sales tax state. Start filing your tax return now. This takes into account the rates on the state level county level city level and special level.

Local tax rates in Utah range from 0 to 4 making the sales tax range in Utah 47 to 87. Start filing your tax return now. The Utah County Utah sales tax is 675 consisting of 470 Utah state sales tax and 205 Utah County local sales taxesThe local sales tax consists of a 180 county sales tax and.

File electronically using Taxpayer. If you need access to a database of all Utah local sales tax. This is the total of state and county sales tax rates.

Your household income location filing status and number of personal exemptions. Pay directly to the Utah County Treasurer located at 100 E Center Street Suite 1200 main floor Provo UT. The most populous county.

Our free online Utah sales tax calculator calculates exact sales tax by state county city or ZIP code. Please note that our offices will be closed November 24 and November 25 2022. The minimum combined 2022 sales tax rate for Utah County Utah is.

This means you should be charging Utah customers the sales tax rate for where your business is located. Tax rates are also available online at Utah Sales Use Tax Rates or you. The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors.

Our free online Utah sales tax calculator calculates exact sales tax by state county city or ZIP code. Utah sales tax rates vary depending on. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 749 in Salt Lake County Utah.

What is the sales tax rate in Utah County. Sales Tax Table For Salt Lake County Utah. 2022 Utah Sales Tax By County Utah has 340 cities.

The average cumulative sales tax rate between all of them is 721. The most populous location in Utah County Utah is Provo. Average Sales Tax With Local.

Let S Get Fiscal Utah Vehicle Sales Tax Talk From Ksl Cars

How To Calculate Sales Tax And Avoid Audits Article

Utah Vehicle Sales Tax Fees Calculator Find The Best Car Price

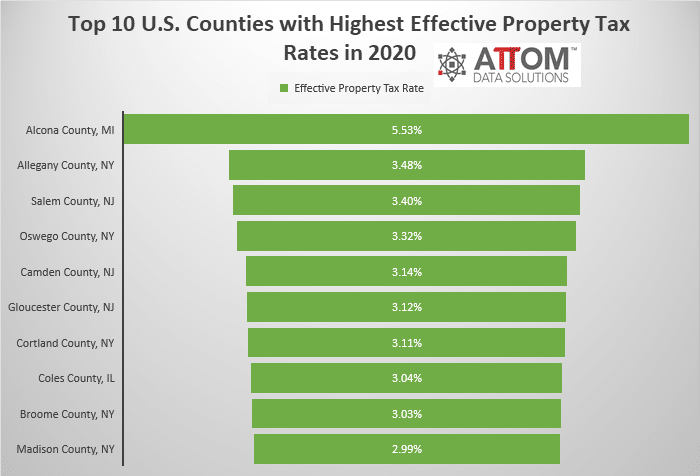

Top 10 U S Counties With Highest Effective Property Tax Rates Attom

Etsy Sales Tax When And How To Collect It Sellbrite

Online Sales Tax In 2022 For Ecommerce Businesses By State

How Do State And Local Sales Taxes Work Tax Policy Center

Sales Tax Calculator And Rate Lookup Tool Avalara

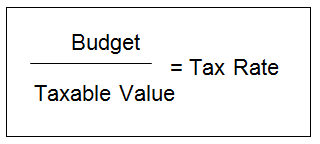

How Property Tax Works In Utah

Utah Income Tax Rate And Brackets 2019

Property Taxes Levied On Single Family Homes Up 5 4 Percent Attom

Utah Property Tax Calculator Smartasset

.png)

State And Local Sales Tax Rates Midyear 2013 Tax Foundation

Car Tax By State Usa Manual Car Sales Tax Calculator

Truth In Taxation Summit County Ut Official Website

Individual Income Tax Structures In Selected States The Civic Federation